International orders shipped from a Shipwire warehouse to customers in a different country require additional paperwork for customs processing. Export orders from the U.S. that do not have a HTS number or ECCN code defined for the products in the shipment will result in the order being placed on hold. Although Shipwire takes care of this paperwork for you, we require that you provide us with some basic information to ensure export compliance to avoid delays:

HTS (Harmonized Tariff Schedule)

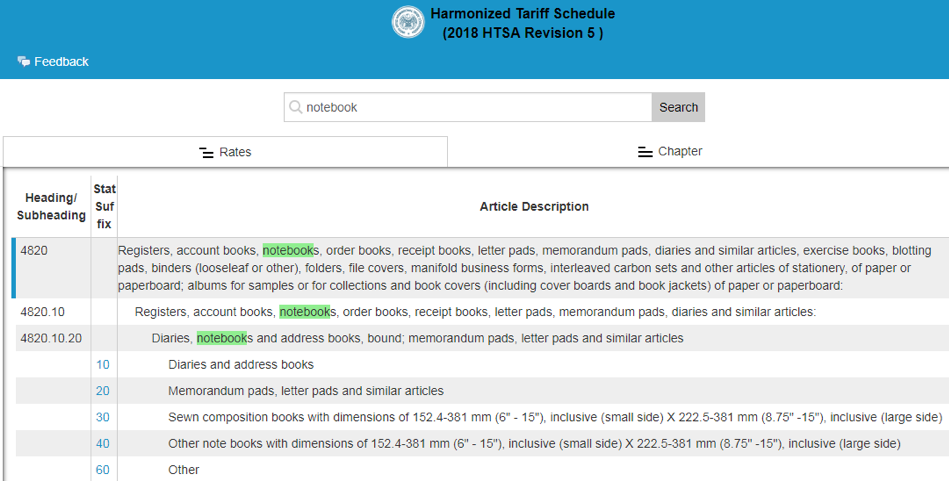

The HTS 10-digit code is the primary resource for determining tariff (customs duties) classifications for commodities. Outside of the U.S. it is referred to as the HS (Harmonized System) code.

→ See searchable list of HTS Codes

→ Popular HTS rulings

Example: A diary would have a 10-digit HTS code of 4820102010.

ECCN (Export Control Classification Number) 5-character code

The ECCN code, similar to the HTS code, is a representative code for the commodity. If your item falls under U.S. Department of Commerce jurisdiction, and is not listed/described on the Commerce Control List, it is designated as ECCN: EAR99. A majority of products are ECCN code EAR99 and often times consist of low-technology consumer goods and do not require a license in many situations. However, if you plan to export an EAR99 item to an embargoed country, to an end-user of concern, or in support of a prohibited end-use, you may be required to obtain a license. In addition, some other ECCN codes may be flagged as requiring license information. Our export compliance team will reach out to you if additional information is required.

→ See code tables:

- https://www.bis.doc.gov/index.php/regulations/commerce-control-list-ccl

- https://www.bis.doc.gov/index.php/regulations/export-administration-regulations-ear

Update Your Product Catalog to Avoid Order Holds

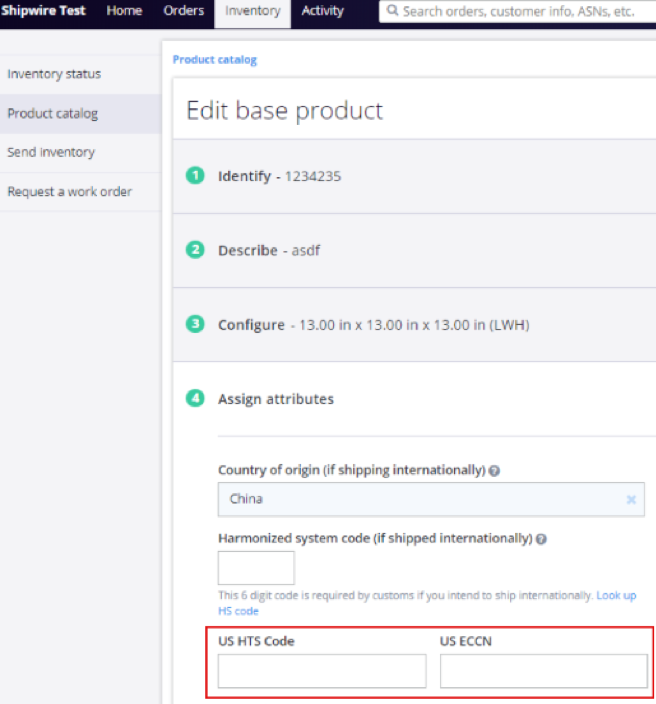

To add new individual products or edit existing individual products in Shipwire, select the Inventory tab and Product Catalog. HTS and ECCN fields are located in step 4, Assign Attributes. Enter your 10-digit HTS code and 5-character ECCN code in the appropriate fields.

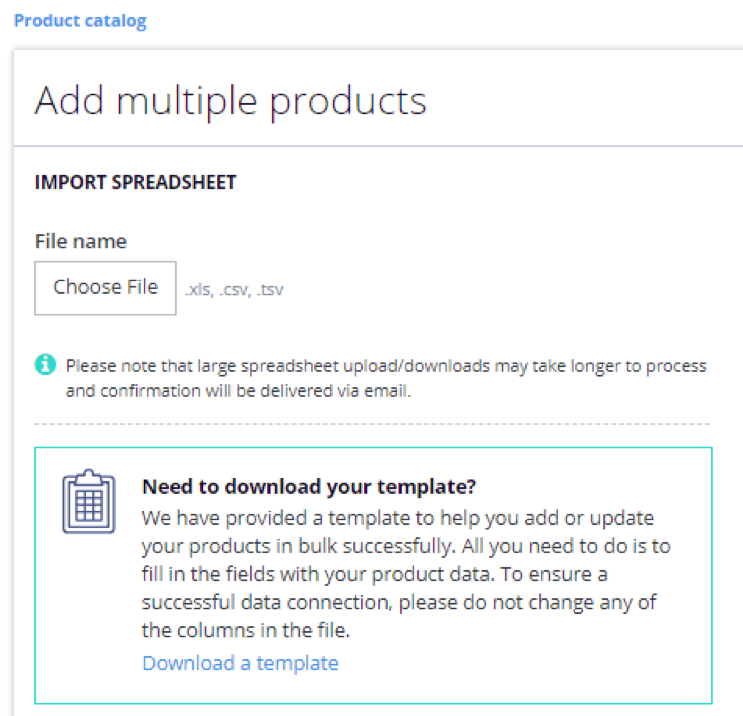

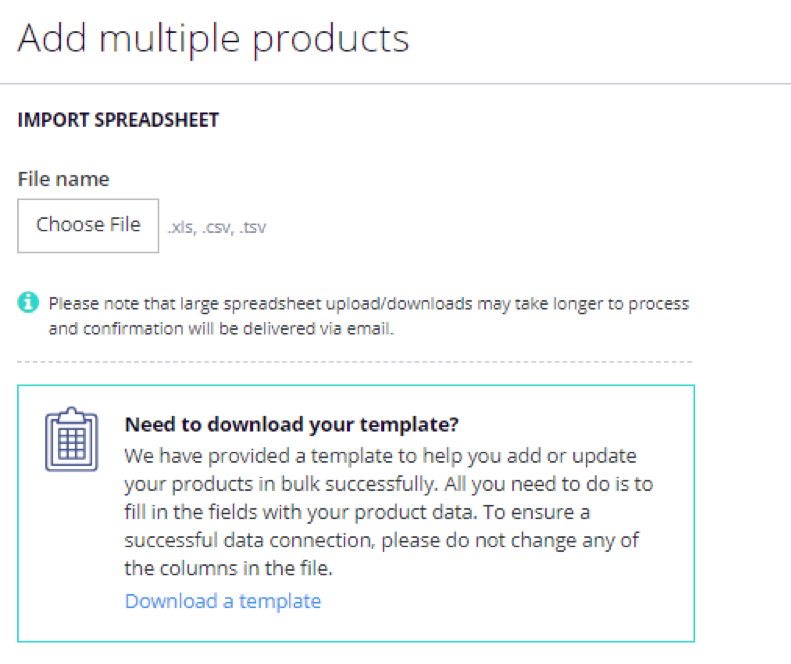

If you have many products to edit, it may be fast to use our spreadsheet upload option. In your product catalog, select “Add Multiple Products.”

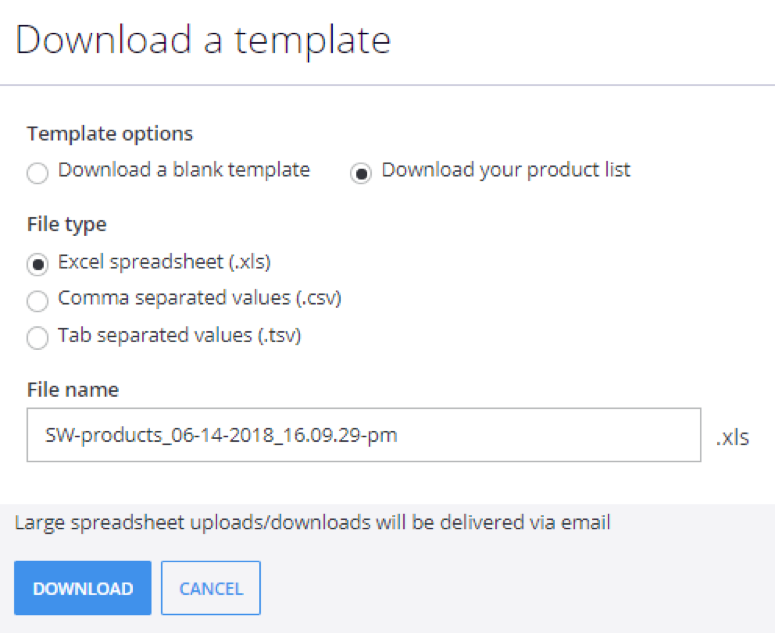

Select “Download a template.”

Select “Download your product list”.

In the downloaded spreadsheet, add your 10-digit HTS codes to column [HTS_code_US] and your 5-character ECCN codes to column [ECCN_US]. Note you cannot use special characters in these fields. Re-upload your product catalog by selecting “Choose file”.

Orders on Hold Due to Missing HTS and/or ECCN Codes

To release orders held for containing products missing HTS and/or ECCN codes, you will need to update those products with the appropriate codes in the Product Catalog or via spreadsheet upload as described above. Once updated, order(s) will release and flow as normal.

Learn more about other aspects of the Shipwire Platform’s handling of international orders here.

For questions on updating your product catalog or held orders due to missing HTS and ECCN codes, please contact customercare@ingrammicroservices.com.

Bureau of Industry and Security Helpful Links for ECCN

Contact BIS

https://www.bis.doc.gov/index.php/about-bis/contact-bis

BIS Full Commerce Control List (CCL)

https://www.bis.doc.gov/index.php/documents/regulation-docs/1561-ccl-categories-0-9/file

BIS The Commerce Control List (Part 774) – includes introduction with several supplements on various topics.

Supplement 4 goes through the order of review when determining the ECCN for your item.

https://www.bis.doc.gov/index.php/documents/regulation-docs/435-part-774-the-commerce-control-list/file

BIS CCL Overview and Country Chart (Part 738) goes through the structure, composition of an entry and reading an ECCN and how to determine if an export license is required.

https://www.bis.doc.gov/index.php/documents/regulation-docs/414-part-738-commerce-control-list-overview-and-the-country-chart/file

BIS ECCN Classification Request Guidelines for when you ask BIS to classify your item for you.

https://www.bis.doc.gov/index.php/licensing/commerce-control-list-classification/classification-request-guidelines

Link to SNAP-R where requests for classification should be made electronically.

https://snapr.bis.doc.gov/snapr/

SNAP-R Online Help for Exporters

https://snapr.bis.doc.gov/snapr/docs/loginHelp.html

SNAP-R Frequently Asked Questions

https://snapr.bis.doc.gov/snapr/docs/snaprFAQ.htm

The CCATS (Commodity Classification Automated Tracking System) is the code number assigned by BIS to products that BIS has classified. This provides the ECCN Classification and any restrictions on exporting the product.

Products with encryption have additional controls. Here is a link to Encryption and how to classify products with encryption

https://www.bis.doc.gov/index.php/policy-guidance/encryption

BIS Definition of Terms

https://www.bis.doc.gov/index.php/documents/regulation-docs/434-part-772-definitions-of-terms/file

BIS Presentation “Export Control Classification Numbers (ECCN)”

https://www.bis.doc.gov/index.php/forms-documents/regulations-docs/143-bis-eccn-pdf/file

BIS Presentation “How to Classify Your Item”

https://www.bis.doc.gov/index.php/documents/compliance-training/export-administration-regulations-training/247-howtoclassifyitem-pdf/file

BIS Presentation “Classification of Items on the Commerce Control List”

https://www.bis.doc.gov/index.php/forms-documents/compliance-training/export-administration-regulations-training/243-whatisaneccn-pdf/file

There are also 2 short videos specifically on the topic of CCL and Self-Classification

https://www.census.gov/foreign-trade/data/video006.html

Exporting Commercial Items: ECCNs and EAR99

https://www.census.gov/foreign-trade/data/video005.html

BIS Presentation “Introduction to Commerce Department Export Controls”

https://www.bis.doc.gov/index.php/forms-documents/regulations-docs/142-eccn-pdf/file